iowa inheritance tax rate

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. How do I avoid inheritance tax in Iowa.

How Much Is Inheritance Tax Community Tax

619 a law which will phase out inheritance taxes at a.

. For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40. Iowa is also working on phasing out its inheritance tax by.

File a W-2 or 1099. Menu burger Close thin. Learn About Sales.

How much is the inheritance tax in Iowa. Dividend Tax rate 202122 Dividend Tax rate 202223 Basic. Learn About Property Tax.

If instead you are a sibling or other non-linear ancestor then you are subject to. There is no estate tax in Iowa. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated.

If the net estate of the decedent found on line 5 of IA. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Inheritance Tax Rates Schedule.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. Read more about Inheritance Tax Rates Schedule. Schedule B beneficiaries include siblings half.

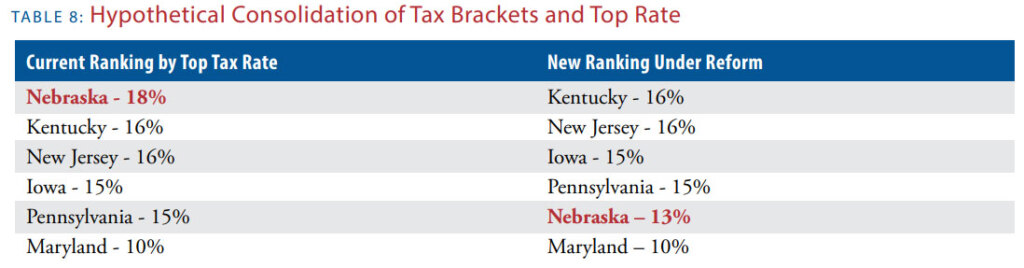

That is worse than Iowas top inheritance tax rate of 15. For more information on the limitations of the inheritance tax clearance see Iowa. 60-064 05312022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

That is worse than Iowas top inheritance tax rate of 15. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. Aunts uncles cousins nieces and nephews of the decedent.

How much is the inheritance tax in Iowa. Iowa Inheritance Tax Rates. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

These tax rates are based upon the relationship of. It has an inheritance tax with a top tax rate of 18. It is one of 38 states in the country that does not levy a tax on estates.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. A summary of the different categories is as follows. On May 19th 2021 the Iowa Legislature similarly passed SF.

Up to 25 cash back How much inheritance tax each beneficiary owes depends on the beneficiarys relationship to the deceased as well as how much the beneficiary inherited. If the net value of the decedents estate is less than 25000 then no tax is applied. Iowa does not levy an inheritance tax in cases where the decedents entire net estate is valued at 25000 or less.

Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. What is Iowa inheritance tax. There is a federal estate tax that may apply.

Which is better than our neighboring state of Nebraska which has the highest top inheritance tax rate of 18 In case you were. The following Inheritance Tax rates will apply to a decedents beneficiary who is a. A bigger difference between the two.

0-50K has an Iowa inheritance tax rate of. It has an inheritance tax with a top tax rate of 18. In 2013 the Indiana legislature repealed their inheritance tax completely.

Iowas max inheritance tax rate is 15.

Inheritance Tax 2022 Casaplorer

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

Estate Tax Rates Forms For 2022 State By State Table

Death And Taxes Nebraska S Inheritance Tax

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Death And Taxes Nebraska S Inheritance Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

How Much Is Inheritance Tax Community Tax

.png)

Iowa Inheritance Tax Law Explained

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

What Is Inheritance Tax Probate Advance

Estate Tax Definition Tax Rates And Who Pays White Coat Investor