dallas texas local sales tax rate

The current total local sales tax rate in Dallas County TX is 6250. TX Sales Tax Rate.

Round Rock Suing To Protect Millions It Reaps From Online Sales Taxes

The rates shown are for each jurisdiction and.

. Dallas Co 2057217 010000 082500 Allentown 067500. Enter the Address City and Zip Code in the above fields to obtain the tax jurisdiction s and tax rate s for the address entered. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

The December 2020 total local sales tax rate was also 6250. Dallas collects the maximum legal local sales tax. TEXAS SALES AND USE TAX RATES April 2022.

The current total local sales tax rate in Lake Dallas TX is 8250. City sales and use tax codes and rates. The December 2020 total local sales tax rate was also 8250.

Denton TX Sales Tax Rate. Sales Tax Rate Locator. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and.

The Dallas Texas sales tax is 625 the same as the Texas state sales tax. Free Unlimited Searches Try Now. Local Sales Tax Rate Information Report.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. There are a total of 981 local. The Texas state sales tax rate is currently.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum. Ad Get State Sales Tax Rates. Download tax rate tables by state or find rates for individual addresses.

Average Sales Tax With Local. The 825 sales tax rate in. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months.

Combined Area Sales and Use Tax In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose. While many other states allow counties and other localities to collect a local option sales tax Texas does not. Texas Comptroller of Public Accounts.

2022 Tax Rates Estimated 2021 Tax Rates. Ad Get State Sales Tax Rates. The current total local sales tax rate in Dallas TX is.

214 653-7811 Fax. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax. If an exact rate.

Dallas TX Sales Tax Rate. Download tax rate tables by state or find rates for individual addresses. Free Unlimited Searches Try Now.

TEXAS SALES AND USE TAX RATES April 2022. The 2018 United States Supreme Court decision in South Dakota v. The Dallas County sales tax rate is.

Texas Sales Tax Small Business Guide Truic

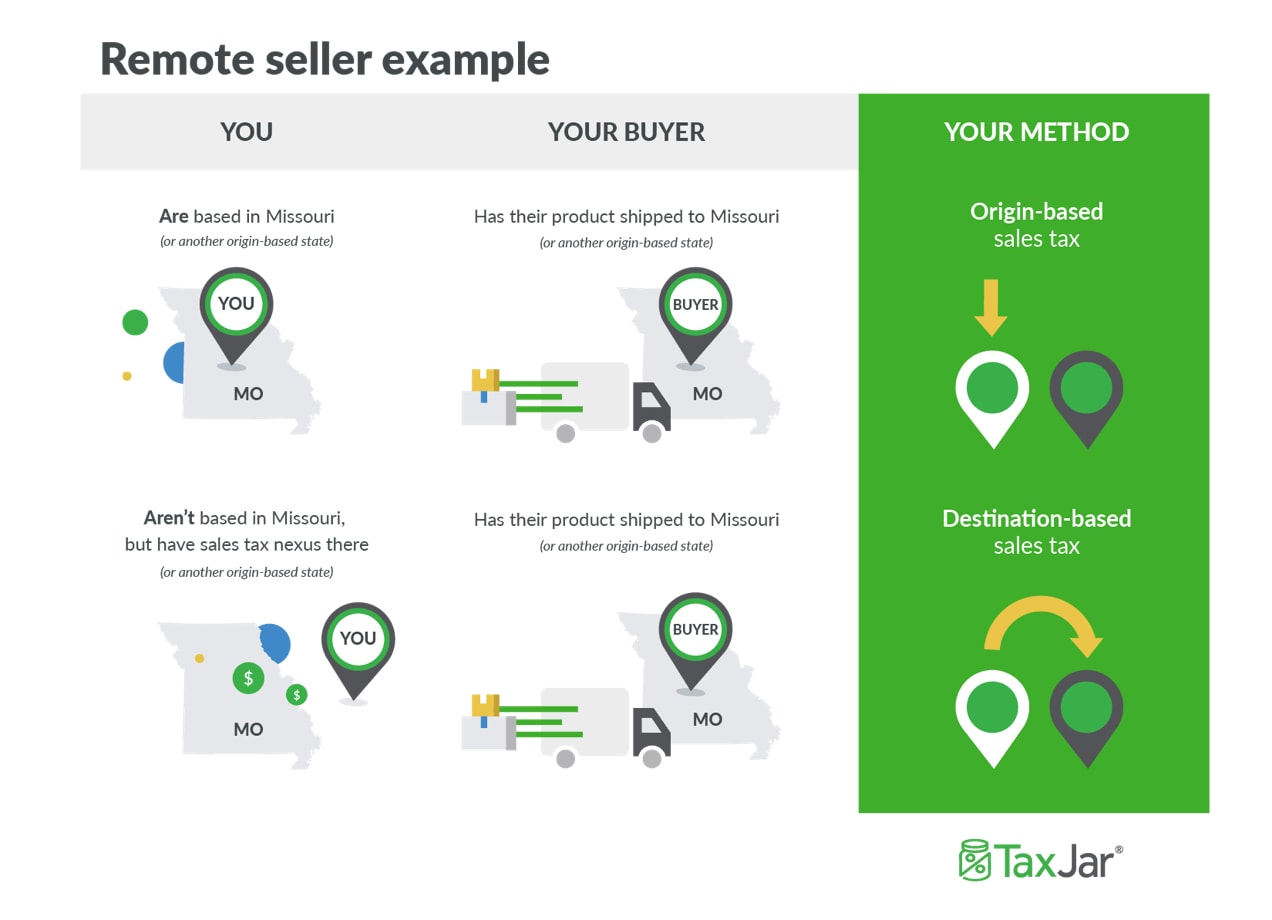

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Tax Rates Richardson Economic Development Partnership

2021 2022 Tax Information Euless Tx

Tax Information City Of Sachse Official Website

How To Charge Your Customers The Correct Sales Tax Rates

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Texas Sales Tax Guide For Businesses

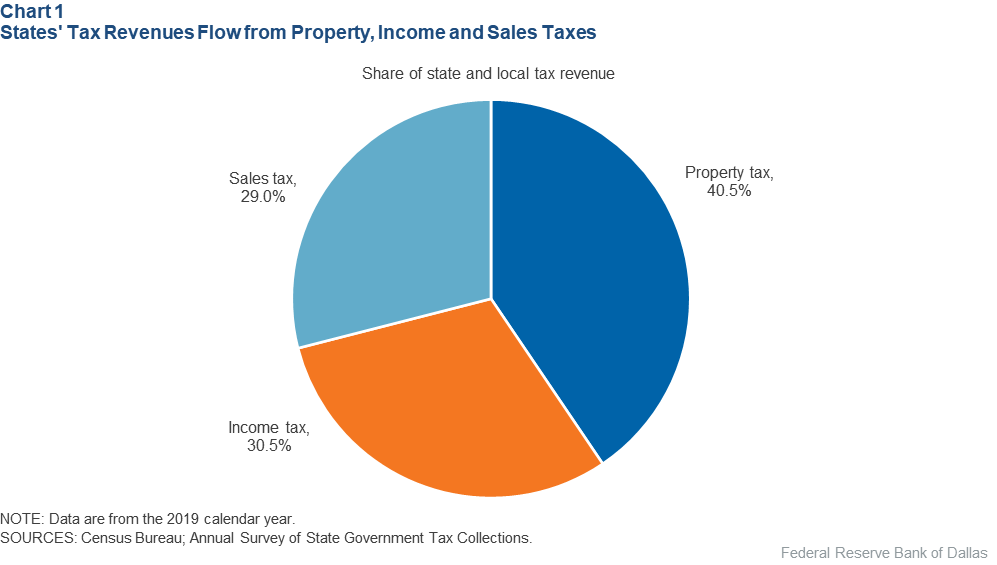

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide And Calculator 2022 Taxjar

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Car Sales Tax In Texas Getjerry Com

Texas Sales Tax Rates By City County 2022

Worksheet For Completing The Sales And Use Tax Return Form 01 117

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers